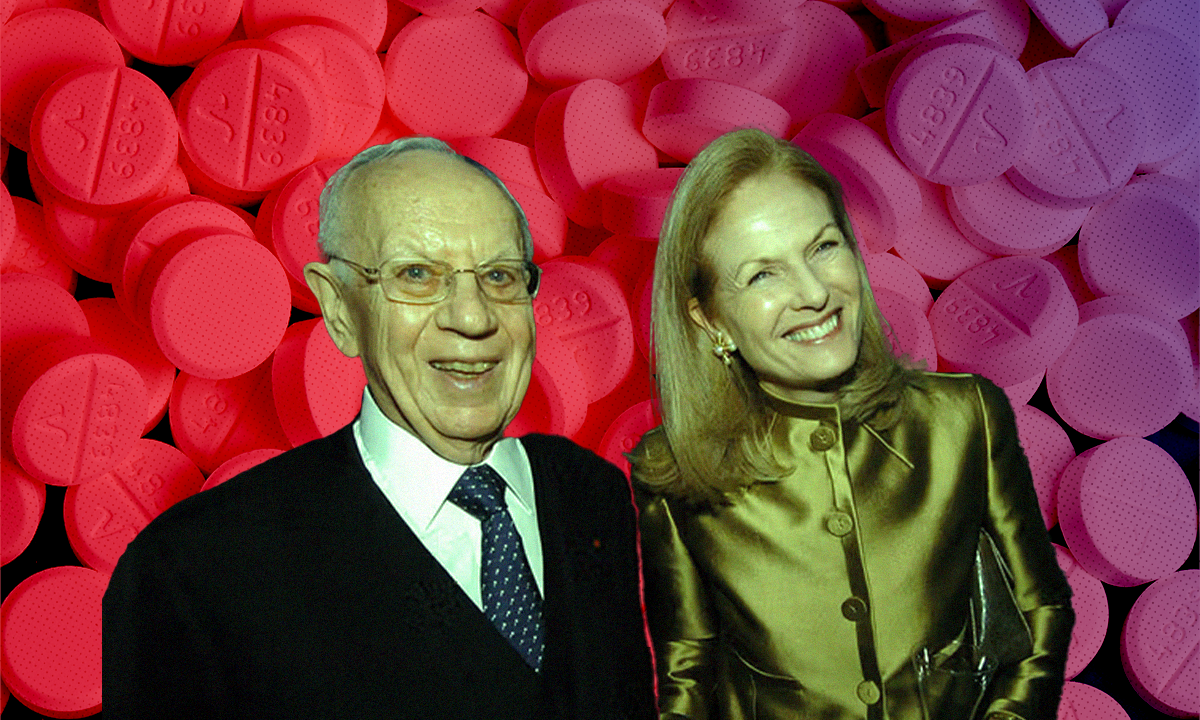

Some members of the notorious Sackler family have returned to blaming doctors for the opioid crisis. Are they even wrong?

The following story is co-published with Matt Bivens’ Substack newsletter, The 100 Days.

A court filing last month by members of the Sackler family — the billionaire owners of Purdue Pharma, which sold its opioids with legendary dishonesty and aggression — says the company was “thriving” until it was harassed to death by questionable lawsuits.

The filing includes a chart showing how a trickle of opioid-related lawsuits over the years abruptly grew in 2017 to what the indignant Sackler family variously calls a “flood,” an “avalanche,” a “tsunami”. This, they say, quickly drowned their profitable business:

It’s a funny little graphic; such an oddly selective, 11-year snapshot of this 25-year, ongoing catastrophe we call the Opioid Crisis.

I’ve decided to add some context:

They sucked out all the money, then blamed ‘lawsuits’

The Sacklers claim sniffily that Purdue was “overwhelmed by the number of suits, not their merit.” They say by the end they were fighting more than 2,600 lawsuits, and spending $2 million every week on legal fees. That’s about $100 million a year, which sounds like a lot. But by my math, it’s also only about 3.5 percent of their annual revenues.

Compare that 3.5 percent to the massive amounts the Sacklers had been routinely withdrawing for themselves annually. Up until the Feds forced them into a 2007 felony plea, the family (as company owners) had been taking out a relatively modest 15 percent of revenues for themselves. But as that 2007 plea deal was being negotiated, the Sacklers were anxiously wringing their hands about losing everything. When one family member in an e-mail observed they were all rich and didn’t want to ever end up poor, another replied-all back: “What do you think is going on in all of these courtrooms right now? We’re rich? For how long? Until which suits get through to the family?”

Immediately after, the Sacklers started withdrawing 70 percent (!) of Purdue’s revenues for themselves. This went on for years — long before lawsuits started costing perhaps 3.5 percent of revenues and supposedly drowned the business.

Billions of dollars made selling opioids were whisked abroad. The U.S. Justice Department characterizes these withdrawals as “the fraudulent transfer of assets from Purdue.” The U.S. Supreme Court describes them thus:

“Fearful that the litigation would eventually impact them directly, the Sacklers initiated a ‘milking program,’ withdrawing from Purdue approximately $11 billion — roughly 75% of the firm’s total assets — over the next decade. Those withdrawals left Purdue in a significantly weakened financial state.”

Once Purdue had been gutted, the Sacklers declared it bankrupt. Creditors, attorneys general from California to Massachusetts, and families of opioid victims were all furious.

The U.S. Justice Department brought — and in 2020, Purdue pled guilty to — a slew of criminal charges, including for defrauding Medicare, deceiving the Drug Enforcement Agency, and paying kickbacks to doctors and others to push medically unnecessary, addictive product. The company was hit with criminal and civil penalties of more than $8 billion.

Importantly, individual Sacklers were also personally forced to pay $225 million in civil damages, and the Justice Department announcement of these settlement resolutions pointedly threatened the family:

“The resolutions do not include the criminal release of any individuals, including members of the Sackler family. … [It] does not resolve claims that states may have against … members of the Sackler family, nor does it impede … [attempts] to recover any fraudulent transfers.”

All of this, the Justice Department added, would be “subject to approval of the bankruptcy court.”

What’ll it cost to make this go away?

But the Sacklers have great lawyers. They sat down with their enemies and offered a trade: the family would pump a few billion dollars back into Purdue’s depleted carcass, to pay off some bills and claims. In return, the Sacklers would keep vast sums of money and would also be granted personal immunity to all kinds of complaints, current or future, related to the opioid business. Once the bankruptcy courts approved this deal, even people not involved in the bankruptcy process would be forever forbidden to sue the Sacklers.

The Supreme Court would later observe how unusual it was to see a bankruptcy process offer individuals — who, by the way, were not themselves declaring personal bankruptcy — broad immunity even for malicious fraud, which would usually be a felony crime: “Ordinarily,” the Court ruling noted archly, bankruptcy rulings don’t grant immunity “against claims based on ‘fraud’ or those alleging ‘willful and malicious injury’.”

Sackler sociopathy is often best seen in the lurid, petty details. The Sacklers initially offered to return $4.325 billion of the $11 billion they had sucked out of Purdue — but only through payments spread out over a decade. They also said Purdue itself would be reimagined as “a public benefit company,” one dedicated “to opioid education and abatement efforts.” The new, noble Purdue would help individuals harmed by the old, sordid Purdue’s opioids: Every qualifying victim could get a one-time $3,500 payment, while more serious cases might qualify for up to $48,000 — paid over 10 years and, of course, only after “deductions for attorneys fees and other expenses.” When this opening bid was rejected, the Sacklers sweetened it with an additional $1.675 billion (so, for a total of $6 billion) — again, in installments to be paid over many years. The lawyers sitting across the table from Team Sackler grudgingly accepted. It’s amazing what a few billion dollars can purchase!

After the bankruptcy court approved this plan, appeals against it rose quickly to the Supreme Court, which this summer knocked down the entire scheme. The above summary is courtesy of the Supreme Court itself, which also honed in on a key point: while Purdue might have declared bankruptcy, the Sacklers had not.

“The Sacklers have not filed for bankruptcy, nor have they placed virtually all their assets on the table for distribution to creditors. Yet, they seek an order discharging a broad sweep of present and future claims against them, including ones for fraud and willful injury,” complained the Court. “In all of these ways, the Sacklers seek to pay less than the [bankrupcy] code ordinarily requires and receive more than it normally permits.”

Choosing pain over fear

The Sacklers and their enemies are now back in bankruptcy negotiations. Opioid litigation against them remains on pause until Dec. 2, the deadline for all sides to reach a new bankruptcy agreement. Mediators involved say a deal may be announced any day now. The newly truculent Sackler court filing is thus just the latest step in that ongoing, five-year dance. But it’s still quite striking. The Sacklers say they aren’t afraid any more of that flood, that avalanche, that tsunami of looming lawsuits. They say they could have won all of those cases in court — and might even still try.

Or at least, the defiant half of the family called “Side B” says this. “Side A” is more appropriately spooked about what the future might hold, and probably remembers Sackler family members being tormented before Congress in the winter of 2020, at the height of COVID-19 lockdowns, in a surreal Zoom-based hearing — during which one congressman said he knew of no family in America “more evil than yours,” another compared the Sacklers to the Mexican drug lord El Chapo and suggested their money be seized and they be jailed, and a third noted the rare level of bipartisan agreement on display: “The actions of your family, we all agree, are sickening.”

They say they could have won all of those cases in court — and might even still try.

Never mind, says the unapologetic wing of this billionaire family. Some may have unfairly attacked pharmaceutical companies like theirs for “the manufacture and sale of FDA-approved opioid medications.” And other opioid manufacturers and distributors — Johnson & Johnson, Walmart and so on — may have all cravenly surrendured, yielding more than $50 billion in settlements.

But not Purdue.

“Purdue has meritorious defenses to all of the Opioid Claims,” now says the Sackler family filing. “Courts have consistently rejected legal claims brought by individuals against Purdue: when a doctor, knowing the risk of addiction, determines that the patient needs FDA-approved opioids and prescribes them, the plaintiff cannot show that Purdue caused the patient to suffer any injury.”

This sounds like the old Purdue. What happened to the new, “public benefit company” Purdue that wanted to pay victims of its past conduct a one-time $3,500 in cash and possibly up to $48,000 (over 10 years, and minus fees and expenses)? It’s like the Sacklers have regressed under the pressure of failing in their scheme to cheaply purchase that “stay out of jail free card.” Emotionally, they’ve gone back in time 20 years, to the days of their infamous press releases boasting about their high-priced lawyers going “65-0” defeating the “frivolous lawsuits” brought by the ordinary people they had harmed:

“The term ‘frivolous lawsuit’ can be a real misnomer,” Purdue’s press release said then. “So-called ‘frivolous lawsuits’ can cause real harm. Lawsuits involving pain medications can frighten pain patients from taking the medications appropriately prescribed for them by their healthcare professionals. And they can frighten the doctors from appropriately prescribing those medications. They can cause innocent people to choose pain over fear. We will not encourage this type of conduct by paying personal injury lawyers bringing absurd lawsuits.”

We will delve deeper into Purdue’s leading role in intentionally creating, and massively profiting from, millions of opioid addictions, which resulted in hundreds of thousands of deaths. First, though, we have to finish exploring the Sackler family’s clever, 20-year-old question:

If all they did was make available an FDA-approved medication, then isn’t this whole situation really the fault of doctors?