This is an excerpt from David Stockmans book:

The GOP primary season has come alive, and the state of play is abysmal. Front and center there is Donald Trump, while everyone else, including a few real Republicans and several neo-con fakers, stumble along far in the rear.

And that’s a terrible shame. America desperately needs a return to old-fashioned GOP governance, yet Donald Trump is not remotely a conservative, let alone even a half-assed Republican. As it is, he fluked into the Oval Office in November 2016 and pro- ceeded to wantonly abandon Republican economic doctrine and badly tarnish the brand. But rather than showing him the door, the floundering remnants of the Republican Party have rallied to the banner of one of the most bombastic, egomaniacal, unfit mountebanks ever to appear on the American political scene.

So, what are the good people of the GOP thinking?Trump’s War on C…Best Price: $13.38Buy New $17.38(as of 11:33 UTC – Details)

To be clear, we have no objection to The Donald’s relent- less and frequently unhinged attacks on the ruling elites of Washington, Wall Street, the mainstream media and the Fortune 500. Indeed, his one abiding virtue is that he has all the right enemies. That is, the Washington political class and the likes of the New York Times, CNN, the broadcast networks, the foreign policy think tanks, and the liberal Silicon Valley billionair.

These are the very people, in fact, whose policies and ideologies threaten the future of America.

But while Trump has the right enemies, he has been hopelessly wrong on the substance of policy. Indeed, when it comes to what the GOP’s core mission should be amidst the ongoing tussle of democratic governance—standing up for free markets, fiscal rec- titude, sound money, personal liberty, and small government at home and non-intervention abroad—Donald Trump has over- whelmingly come down on the wrong side of the issues.

Yet the situation is now so far gone that the election of a true conservative leader in 2024 is the only hope remaining. The very future of constitutional democracy and capitalist prosperity in America is literally at stake. These foundational threats simply cannot endure another four years of Donald Trump in the White House. Nor can it tolerate another election where a woebegone Democrat like Joe Biden wins by default, owing to the simple fact that they are not Donald Trump.

Indeed, the calamity of Joe Biden’s wars, inflation, corruption, and relentless assaults on liberty and constitutional rights is so blatant that the American people will surely be looking to drum the Dems out of office in 2024. So, the chance must not be wasted. It is imperative that well-meaning Republicans and conserva- tives understand Trump’s miserable record as a big spender, easy money-man, hard-core protectionist, immigrant-basher, militarist, and all-around Big Government statist, and look elsewhere for a standard-bearer.

The Donald’s abysmal policy failings are documented in detail and at length in the pages that follow; but first, the myth of the great MAGA Economy should be debunked. A lot of Republican voters, though misguided, are willing to overlook all his egregious egotism, petty bombast, and endless departures from conserva- tive economic principles based on the claim that he delivered the Greatest Economy Ever.

In a word, he didn’t. Not remotely. On the bread-and-butter matters of growth, jobs, inflation, productivity, savings and invest- ment, in fact, his record is among the worst of modern presidents, not the best. Indeed, the US economy’s faltering performance during The Donald’s tenure was worse than that of every one of his modern Democratic predecessors going all the way back to Truman.

To be sure, the very idea that America’s infinitely complex, deeply cyclical, and globalized $26 trillion economy can be assessed by statistical outcomes realized during the arbitrary for- ty-eight calendar months of a presidential term is deeply faulty. That’s because economic cycles and trends begin and end on cal- endars wholly unrelated to presidential terms. So the overwhelm- ing bulk of economic policy claims by all presidents amount to partisan talking points, not credible economic analysis.

For instance, years of bad Fed policy brought the US economy into a thundering tailspin in 2008. So any statistical measure of results for George W. Bush’s tenure has a dismal endpoint, which was largely not his doing.

By the same token, Barack Obama was sworn in at the very bot- tom of the worst recession in post-war history and subsequently benefited from the natural regenerative forces of market capital- ism. His economic growth and jobs numbers, therefore, couldn’t help but be brighter. Yet Obama’s policies had precious little to do with these outcomes—well, except to thwart what might have been a far stronger recovery.

In fact, the overwhelming bulk of economic outcomes during these four-year presidential intervals reflect the combined action of tens of millions of workers, entrepreneurs, managers, inves- tors, consumers, savers, and speculators operating on the (quasi) free market. And that’s even as compromised as the private econ- omy has become owing to government intervention and central bank manipulation.

Indeed, when it comes to the big picture, presidential policy is, by and large, overrated. And in the particular period of 2017 through 2020, The Donald inherited the positive momentum of a ripening business cycle that was overwhelmingly not his doing.

Nevertheless, even if you give Trump credit owed to broader cyclical and historical trends, the facts still leave little room for doubt. Real economic growth averaged just 1.52 percent per annum during Trump’s forty-eight months in the Oval Office. Literally, you can’t find anything that weak over the course of a presidential term since the Korean War!

Of course, circumstances, cycles, and even demographics change so much over long periods of time that reaching way back for comparisons has its limits. Still, real growth over the sixty-two- years between 1954 and 2016 averaged 3.04 percent per annum. That’s exactly twice—to the second decimal point—what material- ized during The Donald’s term.

As it happened, that extended sixty-two-year interval encom- passed nine recessions, eleven presidents, numerous wars, and a goodly number of domestic and international crises. So it’s a fair representation of modern history, not distorted by short-run fluc- tuations owing to cyclical timing factors or aberrations like the Great Financial Crisis (GFC). And yet, and yet. The Donald’s bal- lyhooed MAGA economy grew at just half the rate of what might fairly be called the modern growth norm.

Moreover, when dialed in closer to the present time during which both demographics and long-term policy constraints weak- ened the underlying growth trend, the most apt comparison of the Trump years is with Obama’s second term. Both of which were all part of the extended post-financial crisis recovery cycle, and occurred under a monetary and regulatory regime that was broadly continuous over the eight years in question.

The economic growth rate during Obama’s second term wasn’t anything to write home about, either. But it still computed to 2.18 percent per annum—a rate 40 percent higher than that on The Donald’s watch.

It should be noted here that real final sales of domestic prod- uct are used as a proxy for economic growth for the purpose of consistent comparisons. That’s because it has the analytical virtue of removing from the data short-term inventory fluctuations that are irrelevant to growth over any reasonable period but can badly distort beginning and end points when measuring growth rates via the conventional real GDP series.

With the economic growth data smoothed in this manner, there is no room for doubt. If you want to brag about outcomes during the artificial interval of a presidential term, The Donald and his MAGA partisans should remain as quiet as church mice. They have the worst record ever compiled!

Per Annum Change in Real Final Sales Since 1954:

- Kennedy/Johnson 1960–1968: 4.97 percent.

- Clinton 1992–2000: 3.75 percent.

- Reagan 1980–1988: 3.44 percent.

- Carter 1976–1980: 3.37 percent.

- Eisenhower 1954–1960: 2.92 percent.

- Nixon/Ford 1968–1976: 2.73 percent.

- George H. W. Bush 1988–1992: 2.22 percent.

- George W. Bush 2000–2008: 2.00 percent.

- Obama 2008–2016: 1.74 percent.

- Trump 2016–2020: 1.52 percent.

- All Presidents, 1954–2016: 3.04 percent.

Trump’s defenders, of course, will claim that the great Covid pan- demic knocked his record into a cocked hat, and that he shouldn’t be tagged with the economic plunge of 2020 that originated in China. You can get that argument from The Donald’s own tweet of August 2020 after the economy had been flushed into the ditch by the lockdowns and White House–fueled Covid hysteria:

. . . My Administration and I built the greatest economy in his- tory, of any country, turned it off, saved millions of lives, and now am building an even greater economy than it was before. Jobs are flowing, NASDAQ is already at a record high, the rest to follow. Sit back & watch!

We will refute that bit of nonsense below, but suffice it to note here that the economic contractions of 2020 were due to the sweeping Washington-imposed lockdowns, not the virus itself. And as it happened, Trump was the very author of those lockdowns and the related self-quarantining of a frightened population. All this dis- ruptive Washington interference with normal economic function was announced and promoted week-after-week from the bully pulpit at the Trump White House.

Measured through Q1 2020, thereby discarding the big April- June GDP plunge, brings the average economic growth rate to just 2.10 percent, a figure still near the bottom of the above rank- ings. So even when you set the lockdown mayhem aside, you still can’t make an economic silk purse out of the sow’s ear which was the MAGA economy.

Jobs The Donald Didn’t Create

Nor does the claim that The Donald was a great jobs creator wash, either. For crying out loud, presidents don’t create jobs—capital- ists and businessmen do. And while most presidents are unwilling to give the free market its due, the egomaniacal poseur otherwise known as Donald Trump was especially eager to hog the credit.

Except, there was actually no credit to boast about. There were 145,400,000 NFP (nonfarm payroll) jobs in December 2016 and just 142,475,000 in December 2020. The Donald’s tenure, there- fore, was the only presidential term in which private payrolls in the US economy actually shrank—and by three million jobs to boot. Well, at least since Herbert Hoover!

Again, defenders will blame it on the pandemic, but that doesn’t hold up either. Even if you assume that Trump’s term ended at the pre-pandemic peak in February 2020, the contrast with Obama’s comparable second term is not flattering. Trump’s adjusted monthly jobs growth number was 33 percent smaller than Barry’s.

NFP Job Change Per Month:

- Obama: December 2012 to December 2016: +215,300

- Trump: December 2016 to February 2020: +145,000

When you translate these jobs numbers to annual growth rates, the story is much the same as it was for real economic growth.

During Obama’s second term the annualized growth rate of NFP jobs was +1.86 percent, which compares to an annualized gain of, well, -0.51 percent during The Donald’s term.

And, yes, we can again pretend that the Trump lockdowns and shutdown carnage never happened and stop the calculation in February 2020, but a jobs growth rate of 1.47 percent is still noth- ing to write home about.

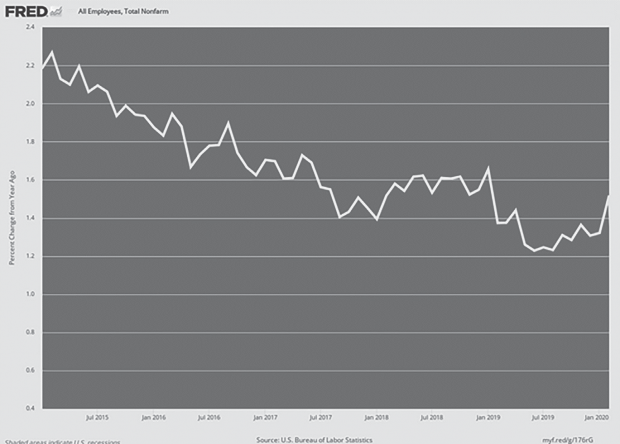

In fact, the rebound of the jobs growth rate from the Great Recession peaked in early 2015 and slid downhill continuously from there—with no discernible reversal during The Donald’s pre- Covid tenure.

The chart below with its downward trending jobs growth rate, of course, won’t be found at a MAGA literature stand.

It takes the air right out of The Donald’s bloated jobs claims.

Y/Y Change in Nonfarm Payroll Jobs, Jan. 2015 to Feb. 2020.

In the broader context of the last half century the job story on The Donald’s watch is not much better. During the twelve presi- dencies between 1945 and 2016, the annualized jobs growth rate computes to 2.14 percent per annum, a figure nearly 44 percent higher than the above cited gain (1.47 percent) under Trump sans the lockdowns.

The MAGA economy thus ended up in the bottom half of the jobs league tables, even when you excise from the record the ten million jobs lost during The Donald’s final ten months in the Oval Office. So the truth of the matter is that when it comes to jobs and economic growth, Trump was the Greatest Boaster Ever, not a superlative generator of economic prosperity.

Annualized Rate of Nonfarm Jobs Growth:

- Kennedy/Johnson 1960–1968: 3.22 percent.

- Carter 1976–1980: 3.11 percent.

- Clinton 1992–2000: 2.43 percent.

- Truman/Eisenhower 1945–1960: 2.14 percent.

- Reagan 1980–1988: 2.04 percent.

- Nixon/Ford 1968–1976: 1.89 percent.

- Obama 2nd Term 2012–2016: 1.86 percent.

- Trump Dec. 2016 Thru February 2020: 1.47 percent.

- George H. W. Bush 1988–1992: 0.60 percent.

- George W. Bush/Obama 1st Term 2000–2012: 0.15 percent.

- Trump Dec. 2016 through Dec. 2020: -0.51 percent.

- All Presidents 1945–2016: 2.14 percent.

Moreover, even the job gains that did occur on the Trump watch through February 2020 were disproportionately in the low-wage or low-productivity sectors of the economy. Thus, of the 6.96 mil- lion increase of nonfarm jobs reported by the Bureau of Labor Statistics during that thirty-eight-month period, 3.7 million or 53 percent were accounted for by government, education and health services, leisure and hospitality industries, personal ser- vices, and business administrative support. By contrast, the high value-added manufacturing, construction, mining, and energy industries generated only 18 percent of the gains in payroll jobs.

One of the reasons for these tepid GDP and jobs growth fig- ures was the fact that the core of the US economy represented by the industrial production index stalled out completely during Trump’s tenure. In fact, in December 2020 it was actually 1 per- cent below the level he inherited in January 2017.

Ironically, the industrial production index encompasses man- ufacturing, mining, energy and gas and electric utility output— the very ailing sectors of the US economy that Trump claimed to champion and fix. As it happened, however, with a -0.21 percent per annum figure, he stood far in the dust compared to the aver- age +2.9 percent per annum gain under the previous twelve presidents after WWII.

Industrial Production Index, January 2017 to December 2020.

Then there is the double-fiction that the MAGA economy was not only booming, but it was inflation-free as well. The facts, of course, say otherwise.

The best measure of medium-term inflation is the 16 percent trimmed mean Consumer Price Index (CPI) because it strains out the high and low monthly outliers which can distort short-term readings. Accordingly, during Obama’s second term, the inflation reading on this measure averaged 1.84 percent per annum, while the figure during The Donald’s four years computes to 2.18 per- cent per year.

Again, inflation is cyclical and a function of Fed and other central bank monetary policies, which rarely aligns with the fixed forty-eight-month term of a US president. Still, not only was inflation accelerating during The Donald’s term, but he was actually fanning the flames via constant demands on the Fed for even lower interest rates and even more inflationary policies.

Thus, in September 2019, when inflation was clearly acceler- ating, The Donald relieved himself of one of the most incoher- ent, ignorant statements on monetary policy ever uttered by a US president. And it was merely more of the same crackpottery that he had been espousing for years: The Origins of MoneyBuy New $5.95(as of 03:22 UTC – Details)

The Origins of MoneyBuy New $5.95(as of 03:22 UTC – Details)

The USA should always be paying the lowest rate. No Inflation! It is only the naïveté of Jay Powell and the Federal Reserve that doesn’t allow us to do what other countries are already doing. A once in a lifetime opportunity that we are missing because of ‘Boneheads’. . .

The Federal Reserve should get our interest rates down to ZERO, or less, and we should then start to refinance our debt. INTEREST COST COULD BE BROUGHT WAY DOWN, while at the same time substantially lengthening the term. . .

This statement is not just a case of The Donald off on a monetary tangent. It’s downright offensive to the very notion of coherent thought. That the US interest rate should always be “the lowest” on the planet, for instance, betrays The Donald’s primitive mantra that winning is all that matters and that what is right is always what is first.

Self-evidently, The Donald is here confusing the Fed’s policy rate target with the rates across the yield curve that the US Treasury pays on its own mountainous debt. So doing, the above comes dangerously close to saying that the key mechanism of capitalist prosperity—the price of money and capital markets securities— should be set by the Fed at ultra-low levels in order to relieve the US Treasury of debt service costs.

Indeed, the level of wild-eyed irresponsibility in the above statement would make historic American monetary quacks like William Jennings Bryan, Huey Long, Wright Patman, and John Connally turn green with envy. In fact, this Trumpian monetary humbug—and it’s only a sample—is so over the top that you sim- ply cannot talk about Trump’s allegedly superior economic stew- ardship with a straight face.

You also can’t limit the MAGA claims strictly to the calendar months of The Donald’s term. That’s because the Fed’s monetary inflation machine was already running in high gear when he took the oath and had been running red hot for years after the so-called emergency of the Great Financial Crisis had fully abated.

So any good steward of American prosperity who chanced to land in the Oval Office in January 2017 should have been doing the opposite of the Trumpian calls for still easier money. That is to say, the vaunted “independence” of the Fed to the contrary not- withstanding, under the circumstances a sound money president would have urged them to stop the printing presses forthwith.

But The Donald doesn’t have the slightest affinity for sound money, owing to reasons we develop below. He therefore has no right on that count alone to claim that he brought the Best Economy Ever to main street America. The crucial truth of the matter is that the Trumpian fiscal bacchanalia of 2020 and the massive money-printing by the Fed which accompanied it is what fueled the outbreak of forty-year high inflation directly thereafter.

For crying out loud, sound money and fiscal rectitude is the sine qua non of sustainable prosperity—so the stagflationary disas- ter which hit the US economy subsequent to The Donald’s term is very much his legacy. It is the product of his noisy insistence on the most profligate Fed money-printing policies in modern times (Chapter 2), slathered with the most reckless outbreak of fiscal responsibility in all of American history (Chapter 4).

As it happened, the Fed’s balance sheet grew at the staggering rate of 13 percent per annum during The Donald’s term. Milton Friedman would have been rolling in his grave and would not have hesitated to say that owing to the lags in monetary policy effect, the virulent inflation that busted out in 2021 was very much gestated by the Fed during The Donald’s watch and pursuant to his endless demands for still easier money.

But here’s the thing. Any historic GOP president—including Bush the Younger and Bush the Elder, as RINO-tending as they were—would never have tolerated the Fed’s print-a-thon, which actually started in September 2019 during the utterly unnecessary bailout of the “repo” market. Yet all the time he was roaming around the White House tweeting economic dumbassery and boasting about the bubble-ridden stock market, The Donald had no clue that the fundamental basis for sustainable prosperity was being savaged by America’s rogue central bank.

Y/Y Change in the 16 Percent Trimmed Mean CPI, 2013 to 2020.

The Lame Foundation of the MAGA Economy

Back in the day, another part of the GOP gospel focused on the crucial significance of productivity growth, which was properly understood to be the true foundation of rising living standards. Low taxes, minimal regulatory intervention, the slimmest possi- ble claim on GDP by government spending and sound monetary policy were the means to this crucial outcome. And over the long stretch from 1954 to 2007, productivity growth did average nearly 2.1 percent per annum.

During The Donald’s four years, however, there definitely was no MAGA magic on the productivity front. The growth rate was only 1.2 percent per annum or barely half of the fifty-six-year average.

Moreover, the reason is not hard to find. Historical US produc- tivity growth has gone AWOL because the main street economy has become freighted down with public and private debt and strip- mined by corporate financial engineering enabled by the Fed.

The Donald’s big spending and easy money policies did noth- ing to reverse these adverse trends. But suffice it here to note that what might be termed the national leverage ratio—total public and private debt as a percentage of GDP—rebounded to record lev- els on The Donald’s watch. Compared to the solid 1.5x ratio that accompanied the nation’s prosperity prior to 1970, the national leverage ratio peaked at 3.82x in 2020.

That meant, in practical terms, that the US economy was lug- ging around $50 trillion of incremental debt compared to what would have prevailed at the historic 1.5x leverage ratio. There is no wonder, therefore, that productivity growth during Trump’s term slid into the sub-basement of modern history.

Total Public and Private Debt as Percent of GDP, 1947 to 2020.

Another cornerstone of long-term growth and wealth creation is net savings from current economic output. This metric mea- sures true economic savings, or the amount of resources left for new investment in productivity and growth after government bor- rowings have been subtracted from private household and busi- ness savings.

As depicted in the chart, that ratio averaged 7.5 percent to 10 percent of GDP in the economic heyday before 1980. But espe- cially after the money-pumping era of Greenspan and his heirs and assigns commenced in the early 1990s, the net national savings ratio headed relentlessly south.

The Donald’s tenure did not reverse that baleful trend, either. Indeed, it might be well and truly said that the runaway spending and borrowing of the Trump years delivered the coup de grace. By 2022 the ratio was an anemic 1.0 percent of GDP—a sheer round- ing error in the sweep of post-war history.

For want of doubt, consider the absolute dollar figures embed- ded in the ratio chart below. The actual net national savings in 2022 at 1.0 percent of GDP was just $260 billion, but that figure would have computed to $1.960 trillion at the 7.5 percent net sav- ings rate of the pre-1980 period.

In a word, $1.7 trillion of national savings has gone missing on an annual basis. Gross savings in the private sector have fallen sharply, even as governments have scarfed up most of the avail- able new private savings to fund massive, serial budget deficits. And, yes, the Trump years comprised the very apotheosis of that darkening trend.

Net National Savings Rate, 1955 to 2022.

As it has happened, real economic growth dropped from a trend rate of 3.5 percent per year before the turn of the century to barely 1.5 percent per annum since then. At the end of the day, the reason for this severe deterioration is that real private investment has stopped growing due to savings being channeled into private speculation and massive public debts—the latter having become far worse on The Donald’s watch than ever before.

Indeed, since the year 2000, real net investment—which strains out the inflation and the annual depreciation from the gross investment figures—had dropped from $953 billion to $721 bil- lion in 2020. Stated differently, main street experienced a deep cut in the motor fuel of growth and rising prosperity, and the MAGA economy did absolutely nothing to reverse that trend.

Real Net Private Investment, 2000 to 2020.

Of course, the ultimate purpose of growth, jobs, savings, pro- ductivity, and investment is to generate rising societal wealth and living standards. Yet when it comes to the key metric for that cru- cial objective, the MAGA economy ranks damn near the bottom of that league table, as well.

In fact, the proxy for American living standards—real GDP per capita—during Trump’s term rose by only two-fifths of the aver- age level posted over the half century after the US economy got back on a peacetime footing in 1947.

So, when it comes to The Donald’s MAGA boasting, there is absolutely nothing to brag about.

Per Annum Growth in Per Capita Real GDP, 1947–2023

- Kennedy-Johnson, 1960–1968: +3.93 percent.

- Truman, 1947–1952: +3.43 percent.

- Reagan, 1980–1988: +2.62 percent.

- Clinton, 1992–2000: +2.60 percent.

- Carter, 1976–1980: +2.07 percent.

- Nixon-Ford, 1968–1976: +1.67 percent.

- Obama, 2008–2016: +1.06 percent.

- Trump, 2016–2020: +1.03 percent.

- Bush the Elder, 1988–1992: +0.97 percent.

- Bush the Younger: +0.91 percent.

- Eisenhower: +0.72 percent.

- All presidents, 1947–2000: +2.45 percent.